When discussing home ownership, or mortgage payments, you've probably heard the term "home equity." Although it may sound intimidating, especially when paired with the word "loan," home equity is quite easy to understand. However, knowing it is imperative if you are planning on selling your home, taking out a home equity loan, or determining how much you owe on your home.

What is home equity?

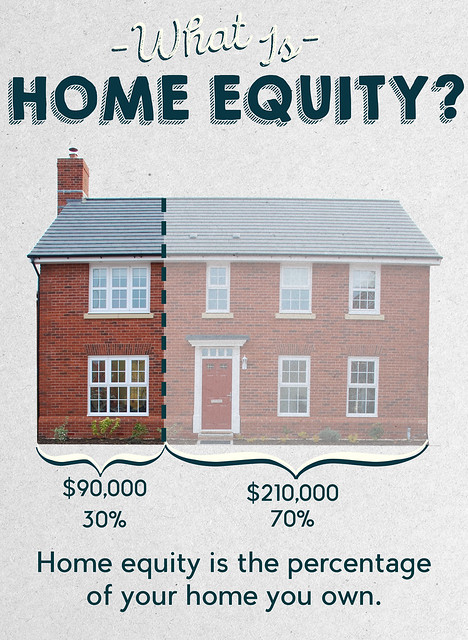

When you look at how much equity you have in your home, you're simply looking at how much of your home you own.

When you start out buying a home with a loan, you usually put a down payment. This can be between 3% and 20% of the cost of the home. It depends on how much you're willing to spend, as well as the mortgage lender you're borrowing the money from. (Remember, if you purchase a home with a smaller down payment, you'll end up paying more in interest over time. We go into detail in an earlier article.)

After you pay the down payment, the mortgage lender pays the rest of the price of the home to the seller. You then owe that amount of money back to the bank.

If you put a 20% down payment on a home, and the bank paid the other 80%, you would owe the bank that 80%. You would also own 20% of the home, while the bank would owe 80% of it.

As you pay monthly mortgage payments to the bank, you are slowly paying back the money you owe (plus interest) and buying more of the home from the bank. As you pay, you increase the percentage of the home you owe "“ 20, to 30, to 40 to finally the whole 100%. Then, you no longer have mortgage payments and you have bought the home outright.

How much equity you have in the home is the percentage of the home you currently own. If you paid a 20% down payment on the house, you have 20% equity of the home (or whatever dollar amount it was that you put down on the home).

Here's a quick example:

You buy a home worth 300,000. You put down $60,000 (or 20%) for a down payment. At this point in time, you own 20% of the home, and your home equity is $60,000.

As you continually pay your mortgage payments, you increase how much you owe. Once you have paid around $150,000 plus interest, your equity is 50% of the home.

Why is Home Equity Important?

If you're thinking of selling your home, knowing what your home equity is, as well as what the home is worth is important. It may persuade (or dissuade) you from selling your home at a certain time. It's also important to understand equity when applying for a second mortgage or Home Equity loan.

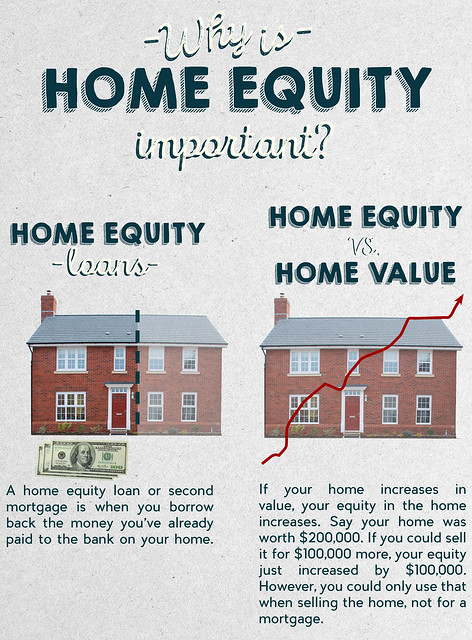

Home Equity Loan

A home equity loan, or a second mortgage, is when you borrow money from you mortgage lender based on the money you have paid on your home. If you have built up home equity of $200,000 on your $300,000 house, you can use the money you have paid on your home as a loan. The mortgage lender will give you the money back, but you will have to pay the money you borrowed back, plus anything you haven't paid on your first mortgage.

It's important for you to understand home equity in this situation, because if you only have a small amount of equity in your home, it may not be a good idea to open a second mortgage. It is also important to remember that a second mortgage uses your home as collateral. If you can't make the payments and you default on your loan, you may be evicted from your home.

There are many different types of mortgages, which you can learn about here.

Home Value vs. Home Equity

Home value and home equity are equally important to understand, especially if you are considering selling a home.

Home value is what your home is currently worth given the market. This can fluctuate depending on a number of different factors. It may increase or decrease. You could buy a home that's worth $200,000 and have its value increase to $300,000 because of the market, or additions you've added onto the home. In a bad market, you could buy your home at $200,000 and have it fall to a home value of much less, whether it's because the property was not well taken care of, the home's systems and appliances were not maintained, or because the housing market wasn't doing well.

Your home equity doesn't change based on the market, however you can increase your equity in the home and the home's value, which we will touch on in the next section of this article. Obviously, if you purchase a home, you want the home value to increase because not only does that help with the resale value, but it also helps with increasing your home's equity. If your $200,000 home increases to $300,000, it's like you've gained $100,000 in equity without paying a penny. That's why many individuals want to increase their home's value "“ they want to increase their equity, as well as increasing the selling price of their home.

Increasing your Home's Equity

Thus, you can see by increasing your home's value would be of interest to individuals looking to increase their equity in their homes. The more a homeowner increases his or her home's value by paying for maintenance, additions and upgrades out of pocket, the more they own of the home. If you pay for additions or upgrades with a loan from the bank, you'll actually be decreasing your equity in the home.

Of course, it's important to remember that not all home improvement projects are equal. There are some that increase a home's value (and your equity if you pay for the project out of pocket) more than others. Take a look at our Home Improvements with the Highest ROI article to learn more.

Home Equity and a Home Warranty

How does a home warranty affect your equity? Since it's not a direct upgrade or addition to your home, it may not effect your equity as much, however, it can increase your home's value. According to a study done by the Service Contract Industry Council, home's sold with a home warranty included sold for $2,300 more money than those without one. A home warranty can help protect wary buyers and provide them peace of mind.

For more information about home warranties, or anything to do with buying or selling a home, look at our blog. You can also see what home warranty plan would work best for you and your home at our plans and pricing page.