As you begin your journey into home ownership, the first few steps you'll make are seeing how much you qualify for with a home loan. This can be stressful, but is a necessary part of your home buying experience. You can find the perfect home for you, but if you don't have enough money to buy it outright and you can't get a mortgage through a lender, you won't be able to purchase it! That's why before you find a home and fall in love with it, you have to determine how much a lender is willing to give you to buy a home.

In order to do this, you must first get pre-approved for a mortgage. Read more on why and how to get pre-approved for a mortgage.

Once you're pre-approved, your lender will send you a pre-approval letter, indicating how much money you qualify for when purchasing a home. Of course, this isn't a legal binding document that allows you to buy a home at that amount of money. A lot of underwriting and research into your financial situation must take place before that happens. However, a pre-approval letter does give you the ability to find a reputable realtor as well as put a legitimate offer on a home. Read and learn more about the differences between pre-qualification, pre-approval and commitment when it comes to mortgages.

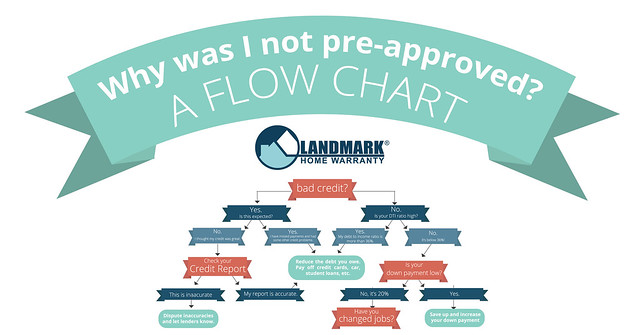

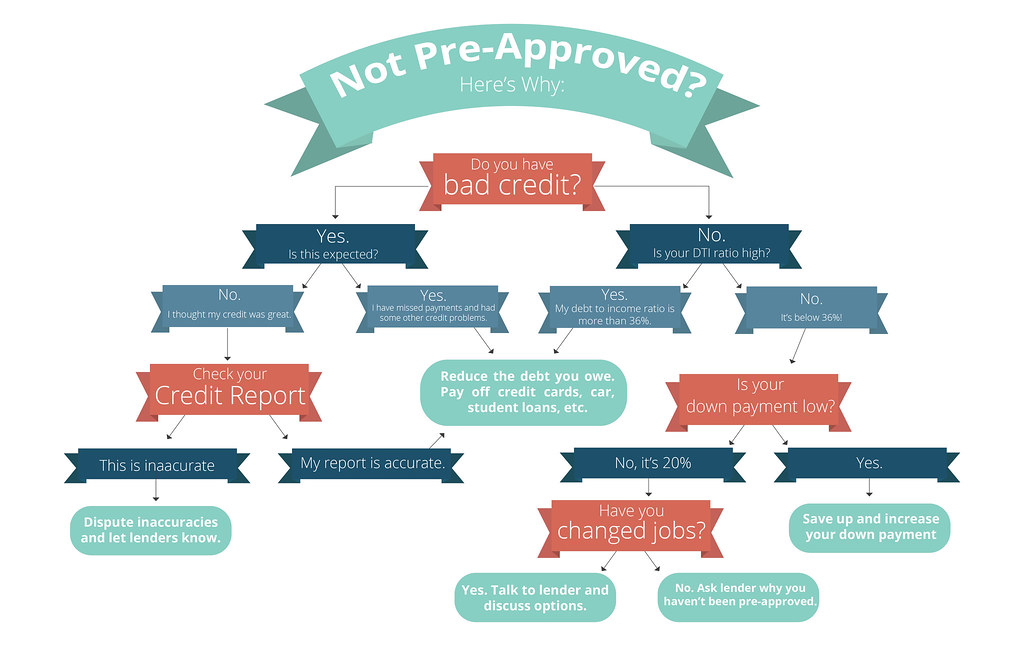

What happens, though, if you aren't pre-approved for a home loan? There are a few different problems with your financials that could stop a lender from feeling comfortable giving you money for a home. Here are 5 issues that can make it so you don't get pre-approved for a mortgage.

Bad Credit Score

One of the things a loan officer will look at when starting your pre-approval process is your credit score. You can get an FHA loan with a 580 credit score, but that's generally the lowest most lenders are comfortable going when lending money. Lenders want to make sure that you will pay back the loan. When you have a lower credit score, it means that you may have missed payments, had a bankruptcy, too many credit cards open, or haven't had them open long enough.

How to Fix it

Changing your credit score is a process, but the first thing you should do is to check your credit report. Not only will this show you what is causing your low credit, but if there's something incorrect on the report, you will be able to work on fixing it. It will also give you some suggestions of what you may want to do to get your credit score up. This will most likely mean reducing some of the debt that you owe and ensuring you pay it back on time.

Incorrect Credit Report

Everyone has the ability to get one free credit report from the government every year. If you're going to be buying a home, it's a great idea to use your one free credit report to check up on any incorrect information and get it fixed before trying to apply for a loan. However, if you don't look at your credit report, if you are not pre-approved, you should look at your credit report to see if there are any problems. If you simply have a low credit score because of the reasons above, you will have to take the steps necessary to fix them. However, if there's something on your credit report that isn't accurate, you can dispute them.

How to Fix it

If you find something on your credit report that's inaccurate, you can dispute the incorrect information. Some of the credit reports let you do this online directly on the credit report.

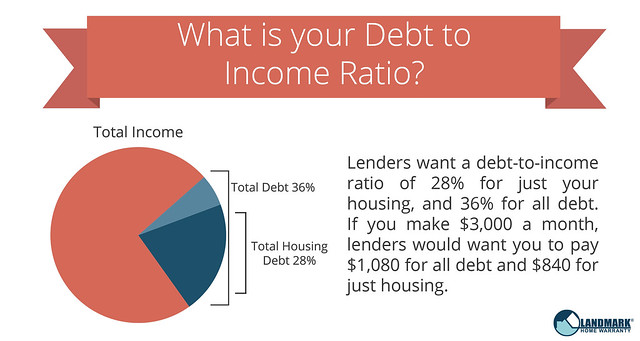

Too High of a Debt to Income Ratio

A debt to income ratio may sound a bit intimidating, but it's quite simple. A mortgage lender will look at how much income you have coming in versus how much you have to pay each month on your accumulative debts. So, if you have a monthly income of $1000 and a car payment that's $100, your debt to income ratio would be 10%. Most lenders want a debt to income ratio of 36% for all of your debt, and 28% for your housing. If lenders look at how much you're making and you don't fit in those numbers, and you don't have enough for a mortgage payment, it's possible that you not be pre-approved for a mortgage.

How to Fix it

To fix this isn't as easy as "getting a brand new, better paying job!" although that might help. The best way to fix this issue is to get rid of some of your debts before trying to purchase a home. You may need to pay down some of your credit cards, or pay more on your car, or sell some of the things that you're paying off that aren't necessities.

Too Low of a Down Payment

If you're only able to give a very small down payment, mortgage lenders may look at how much your payment would be for each month, and see that it is too high for your debt to income ratio. The higher your down payment is on a home, the lower your monthly payment will be. If you can't pay a high down payment, you may have too high of payments for your income.

How to Fix it

If this is why you were not pre-approved for a mortgage, you may just need to save up more for a down payment. There may be higher interest rate loans you can get for smaller down payments, but for a traditional mortgage, the only solution is to get a larger down payment.

Employment Changes

If you've recently changed jobs, or you've been bouncing around from job to job over the last few years, this may reflect badly on your pre-approval. Lenders want a dependable income that they can get paid from monthly. If it seems as though you may not have the same income six months from now, they will be worried about lending you money for a mortgage.

How to Fix it

Ultimately you may be able to explain to your lender why you moved from job to job and how you will ensure that your income will stay steady for a longer period of time. However, the most simple solution is to stay at the same job for more than 6 months to a year in order to show stability.

There are other reasons for individuals to not be able to be pre-approved for a mortgage, but these are the most common. Once you work on these elements, getting pre-approved for a mortgage will be a snap. Of course, once you purchase a home make sure to protect it with a home warranty from Landmark! You can repair or replace your systems and appliances that fail from normal wear and tear for under $100. That's a lot of amazing savings! Check out Landmark's plans and pricing here.